If earning money through wrong means is your aim, then one day you are bound to get trapped, whether you are poor or rich. Similarly, there are some people in our country too, who were once at the peak of success. Because at that time they had everything, wealth, fame… but everything got ruined in no time. Due to greed, they started walking on the path of fraud, which was bound to end one day. The same happened with these 7 billionaires. They were once people’s idol, but now their names are infamous. Business worth crores has sunk, they have fallen from the sky to the ground. Let’s know about them.

Chanda Kochhar: A few years ago, Chanda Kochhar was the CEO and Managing Director of ICICI Bank. She is accused of misusing her position, the investigation reached the CBI. Chanda Kochhar has also been arrested in the bribery case, she is currently out on bail. Chanda Kochhar is accused of taking a bribe of Rs 64 crore.

According to CBI, Chanda Kochhar and her husband Deepak Kochhar bought a flat worth Rs 5.3 crore by paying only Rs 11 lakh. They are accused of taking bribe in exchange for giving loan to Videocon Group companies. In exchange for the loan, Rs 64 crore was invested in Chanda Kochhar’s husband Deepak Kochhar’s Nu Power Limited. The investigating agency claims that ICICI Bank gave a loan of Rs 3250 crore to Videocon Group.

Venugopal Dhoot: Videocon Group promoter Venugopal Dhoot has also gone to jail in a fraud case. Former ICICI Bank CEO Chanda Kochhar is accused of favouring Videocon Group in giving loans. After which Videocon Group benefited Chanda Kochhar’s family in other ways. About 70-year-old Venugopal Dhoot was also arrested in the ICICI Bank fraud case.

According to Forbes magazine, Dhoot’s wealth was around $1.19 billion in 2015. At that time, he was the 61st richest person in India. In 2018, Videocon company filed for bankruptcy proceedings in NCLT. Let us tell you, the company still claims to have launched the first color TV in India as ‘Videocon’. But the empire of Videocon has collapsed in no time. The CBI had accused Chanda Kochhar of irregularities in giving a loan of about Rs 3 thousand crore to the Videocon group.

Malvinder Singh and Shivinder Singh: Ranbaxy Laboratories was once a famous company. This is only a decade old. In the year 2015, Ranbaxy’s promoters Malvinder Singh and Shivinder Singh were jointly placed at number 35 in the Forbes list of India’s richest people, then their wealth was estimated to be 2.5 billion dollars. Now these two have become bankrupt. Both have gone to jail on charges of fraud.

The story of ruin of these two brothers started in the year 2008, when they sold their stake in Ranbaxy to Japanese company Daiichi Sankyo for Rs 9,576 crore. They spent the money received from this in the wrong way. Then they kept sinking in debt and one day Ranbaxy company was also sold. In the year 2016, the total debt on these two brothers was Rs 13,000 crore. Today, along with their business sinking, both of them have also become infamous.

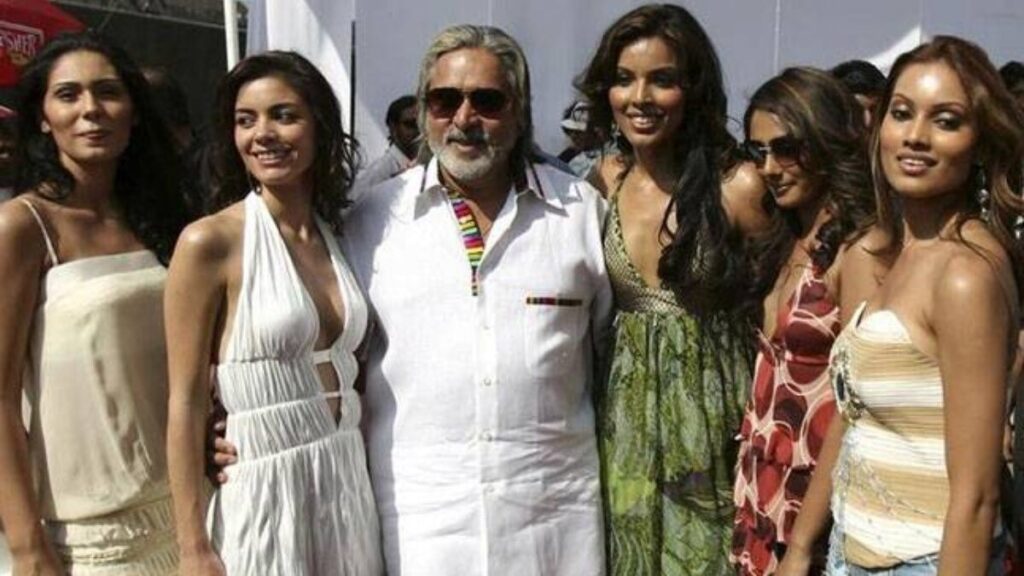

Vijay Mallya: Who doesn’t know Vijay Mallya? Mallya is known for living a luxurious life. But Vijay Mallya’s name has also been associated with fugitive. Because he is absconding after defrauding banks in the country. He is accused of defrauding 17 banks of the country of about 9 thousand crores. Many of his properties in India have been auctioned. At one time Vijay Mallya had many big businesses including airlines. But now it is ruined. Mallya is in Britain since March 2016. The Indian government is constantly trying to bring Mallya back.

Mehul Choksi: Suddenly in the year 2018, Mehul Choksi’s name started making headlines. Because it shook the Indian banking system. Mehul Choksi fled after defrauding Punjab National Bank of Rs 14000 crore. Till about 6 years ago, his net worth was around Rs 1150 crore. But due to a fraud, everything was ruined. Today he is absconding from the country as well. Mehul Choksi is accused in the Rs 13,500 crore PNB scam along with his nephew Nirav Modi. Mehul Choksi founded Gitanjali Group in 1996. Gitanjali still has stores in many cities. Choksi got citizenship of Antigua and Barbuda in December 2017. This case of fraud with PNB came to light in January 2018.

Nirav Modi: The mastermind of the much talked about PNB scam, Nirav Modi, has become penniless today. Nirav Modi’s story is similar to that of Mehul Choksi. Before 2018, most people did not know him as a rich man, but when Punjab National Bank went bankrupt because of him, people started talking about his fraud all over the country. He was known as a diamond businessman from Gujarat. Just 6 years ago, while his total assets were more than Rs 13 thousand crores, now he has become a debtor of more than 30 thousand. Nirav Modi is currently in the custody of London Police. There are many cases registered against him like money laundering, criminal conspiracy and fraud, harassing government employees.

Rana Kapoor: Rana Kapoor was the founder and former managing director and CEO of Yes Bank. But now jail is his second home. After about 4 years, Rana Kapoor came out of jail in April this year. A case is going on against Rana Kapoor for misuse of power and benefiting his family. Due to which the bank suffered huge losses. Because of this, Yes Bank was once on the verge of bankruptcy.

The CBI had registered a case of fraud and criminal conspiracy against Rana Kapoor in March 2020. At the same time, ED investigation is also going on. ED alleges that Rana Kapoor and his family members and others had taken a bribe of about Rs 4300 crore in exchange for getting huge loans from Yes Bank to some companies. If ED is to be believed, during Rana Kapoor’s tenure as chairman, Yes Bank had sanctioned loans worth about Rs 30000 crore, out of which loans worth Rs 20000 crore were converted into bad loans.

Source (PTI) (NDTV) (HINDUSTANTIMES)