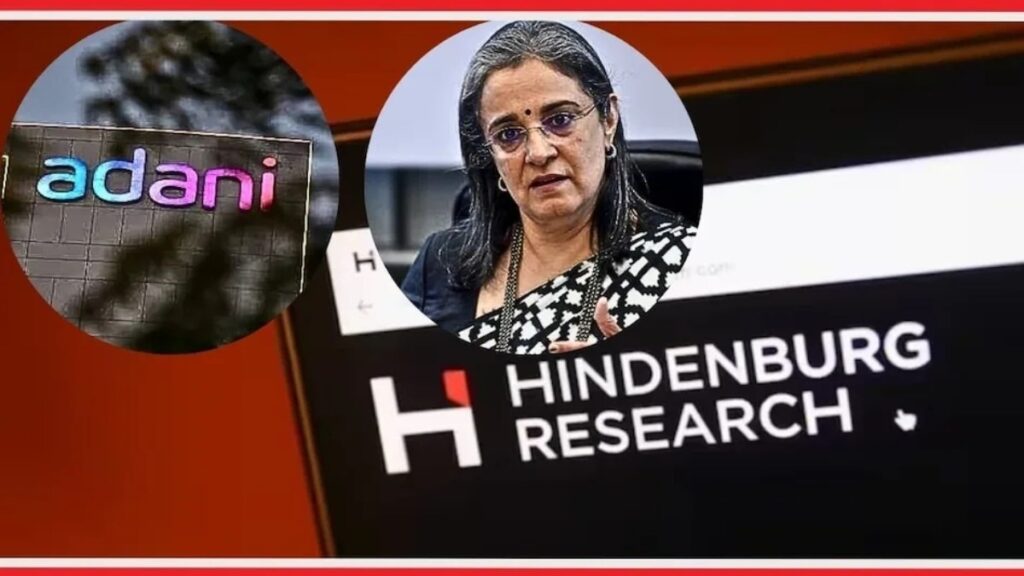

Hindenburg Research is once again in the headlines and after Indian billionaire Gautam Adani, now the target is market regulator SEBI chief Madhuri Puri Buch, on whom the short seller firm has made several serious allegations of collusion with the Adani Group. However, this time too, the American firm is seen targeting the Adani Group by placing a gun on SEBI’s shoulder. The new research report claims that the SEBI chairman had a stake in the offshore funds used in the Adani money siphoning scandal. But meanwhile questions are being raised that this is a report published merely out of a feeling of revenge.

SEBI chief also gave these indications

Is the new report by American short seller Hindenburg driven by a sense of revenge? We are not saying this, but this question is arising in the minds of many market experts. There are reasons behind this, which are pointing towards this. Along with this, SEBI chief Madhabi Puri Buch, who became the target of Hindenburg, while giving her clarification, also indicated that this is merely an attempt to defame her character after the show cause notice issued by SEBI to Hindenburg earlier. Let us understand this in five points…

First point

Amidst the uproar over the Hindenburg report released on 24 January 2023 last year regarding the manipulation of shares of Adani Group companies and the debt on the group, 4 PILs were filed in the Supreme Court, in which an appeal was made to issue an order for investigation against the Adani Group. Regarding these petitions, the Supreme Court had ordered SEBI to investigate on 2 March 2023. After this, on 25 August 2023, SEBI gave a clean chit to the Adani Group. This was a big setback for Hindenburg.

Related news

- Kolkata rape-murder case: ‘Our dreams were shattered in one night’, father reveals what was written in daughter’s diary

- Independence Day 2024 Live Streaming: When and where to watch PM Modi’s address on Independence Day? Here are the direct links

- Independence Day 2024: These 10 British brands were once the pride of the British, today Indians rule them!

- Who is 1989 batch IAS Govind Mohan, who has been appointed as the new Home Secretary

- हिंदोस्तां की मिट्टी के आसमां का जादू, जंग-ए-आज़ादी में ये था उर्दू ज़बां का जादू!

second point

In the report submitted by SEBI to the Supreme Court on August 25, 2023 last year, the market regulator had said that investigation of 22 out of 24 cases has been completed. At the same time, the investigation of two cases is being delayed due to the delay on the part of foreign institutions. Along with giving a clean chit to Adani Group, SEBI had also made several allegations against Hindenburg. This also included violation of SEBI’s Code of Conduct for Research Analyst Regulations by Hindenburg and Nathan Anderson.

Third Point

SEBI had issued a show cause notice to Hindenburg, saying that the report released on the Adani Group misled investors and fabricated a story through fabricated statements, which led to the maximum decline in the share prices of the companies. In the notice, the market regulator said that the short seller firm has also violated local security laws by releasing this report, as it was not even listed as a research firm in India.

Fourth point

Hindenburg’s panic was visible even before releasing its report on market regulator SEBI. When SEBI issued a notice, Hindenburg termed it as an attempt to silence those who warn investors. Not only this, through a post on its website on July 1, 2024, Hindenburg also said that after discussions with sources in the Indian stock market, our understanding is that SEBI started giving secret assistance to the Adani Group immediately after the January 2023 report was published.

Fifth Point

Market experts are calling Hindenburg’s new report an act of revenge, because after all the ups and downs in the Adani-Hindenburg case, the shares of Adani Group companies have finally made a strong comeback. They believe that the Indian stock market is now gaining momentum and this could also be an attempt to destabilize it. Hindenburg cannot fight a legal battle here due to not being registered in India and due to this, SEBI has once again been targeted citing its relations with the Adani Group.

Source (PTI) (NDTV) (HINDUSTANTIMES)